News

News/h2>

More than 3,000 Valley students explore high-tech careers at ASU Prep event

More than 3,000 students explored semiconductors through VR and hands-on activities at Semiconductor Adventure Day with ASU Prep.

Learn MoreUnlocking bilingual success at ASU Prep Phoenix with the Dual Language Immersion Program

ASU Prep Phoenix offers a Dual Language Immersion program to foster bilingual fluency, academic excellence and cultural growth for a global future.

Learn MoreThe incredible Mays Alqasemy: her inspiring path at ASU Prep Phoenix

Mays Alqasemy thrives with an innovative, supportive educational approach at ASU Prep Phoenix, graduating high school early with 60 college credits.

Learn MoreASU Prep’s Family Choice Day: More choice, unlimited possibilities

Family Choice Day at ASU Prep schools gives students the flexible option of at-school or at-home learning on Fridays

Learn MoreA decade strong: ASU takes top spot in innovation for 10th year in a row

For the 10th year in a row, Arizona State University is No. 1 in innovation in the newly released annual “Best Colleges” 2025 rankings by U.S. News & World Report — just one of many top rankings earned by the university.

Learn MoreASU Prep Phoenix High School introduces Transformational Teacher Leaders

The Transformational Teacher Leader (TTL) program is an exciting initiative empowering top-notch educators to shine both in the classroom and as community leaders.

Learn MoreTop-rated middle schools in Phoenix, Arizona 2024

Discover top-rated middle schools in Phoenix, Arizona. Ideal for parents seeking quality education to prepare their kids for college success.

Learn MoreTop-rated high schools in Phoenix (2024)

Discover the top-rated high schools in Phoenix. Ideal for parents seeking excellent education opportunities to prepare their kids for college success.

Learn MoreASU Prep Phoenix & Blue Watermelon Project: Cultivating fresh solutions for our student community

ASU Prep Phoenix partners with Blue Watermelon Project for student well-being, fostering a healthier future through access, education, and transformative strategies.

Learn MoreMeet the Principal of ASU Prep Phoenix

Get to know Kim Higginbotham, the new 7–12 Principal at ASU Prep Phoenix, a premier K–12 school in downtown Phoenix.

Learn MoreVictory dance: ASU Prep Phoenix cheer squad triumphs at competition

Cheer squad at ASU Prep Phoenix, innovative K–12 school, work as team to win first place at the CAA Winter Classic Cheer and Dance Competition.

Learn MoreASU Honors Black History Month with Community Events

Black History Month is an annual celebration of the profound contributions that African Americans have made to all facets of society.

Learn MoreASU Prep Phoenix educator awarded Fulbright U.S. Distinguished Teaching Award

Ms. Agueda Nava Javier was among 20 educators recently awarded the Fulbright U.S. Distinguished Teaching Award.

Learn MoreCoolest event of the year: ASU Prep Phoenix hosts Let it Snow

ASU Prep Phoenix PreK–12 innovative school hosts 'Let It Snow' free community event offering family-friendly fun.

Learn MoreStrong foundations start in Kindergarten.

Learn about our innovative Kindergarten program at an upcoming information-packed session at one of our four elementary locations in the metro Phoenix area.

Learn MoreUpcoming ASU Prep Neighborhood Events

At ASU Prep, we believe that a strong and vibrant community is fundamental to the success of our students!

Learn MoreDía de los Muertos event celebrates the magic of tradition and community

ASU Prep K–12 tuition free public school honors tradition and encourages family involvement with its Día de los Muertos community event.

Learn MoreThe legacy lives on: celebrating Native American Heritage Month

ASU Prep celebrates the history of Native American Heritage Month with ways to learn and honor the many contributions of indigenous people.

Learn MoreAccelerating Math Skills: ASU Prep’s Math Momentum Program

ASU Prep’s innovative Math Momentum program offers personalized education strategies, boosting math skills in Arizona schools.

Learn MoreASU Prep’s Science of Reading training program is empowering educators and achieving student success

Ensuring students can read proficiently is a critical goal for schools and educators.

Learn MorePractical STEM education for high school students: the EPICS program

Get to know the ASU Prep’s EPICS program, connecting students to practical STEM education, real-world STEM experiences, potential STEM careers.

Learn MoreExciting news: ASU Prep Global named a 2023 Yass Prize Semifinalist!

ASU Prep Global is proud to be named a 2023 Yass Prize Semifinalist, selected from nearly 2,000 applications representing 27 million students in grades PreK–12 across all 50 states.

Learn MoreTo Be Globally Competitive, the U.S. Must Value STEM as Much as Literacy

K-12 education needs to be rethought and redesigned: The engine for STEM learning is curiosity and imagination.

Learn MoreHere’s how Arizona teachers are adapting — not attacking — AI

“We’re like the happy cheerleaders for AI," said Janel White-Taylor, clinical professor at Mary Lou Fulton Teachers College.

Learn MoreSchools Worth Visiting

For many years (at least until 2020), we visited about 100 innovative schools a year.

Learn More3, 2, 1…Launch Party!

This mission, aimed at exploring a metal-rich asteroid also named Psyche, marks the first deep-space venture led by Arizona State University.

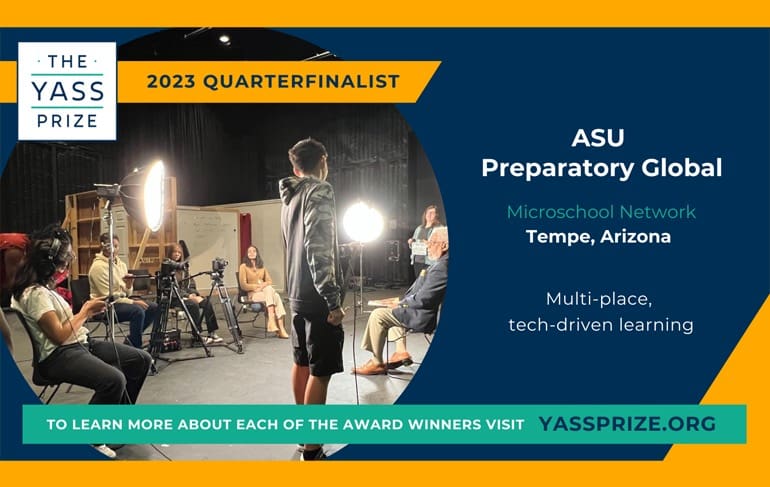

Learn MoreASU Prep Global, trailblazer in education, announced as Yass Prize Quarterfinalist

As ASU Prep Global moves forward in the Yass Prize journey, we look forward to engaging in unique conversations with industry experts.

Learn MoreASU ranked No. 1 in innovation for 9th straight year

For the ninth year in a row, Arizona State University is No. 1 in innovation among American universities, ahead of Stanford, MIT and Caltech, in the newly released annual “Best Colleges” 2024 rankings by U.S. News & World Report.

Learn More9/11 is Patriot Day: a National Day of Service and Remembrance

September 11, 2001 is a day that will forever be etched in the hearts and minds of Americans.

Learn MoreCelebrate Hispanic Heritage Month

Every year from September 15 to October 15, the United States celebrates National Hispanic Heritage Month.

Learn MoreExcellence in Education

We are shining a spotlight on two remarkable individuals who have been recognized for their outstanding contributions to ASU Prep.

Learn MoreDiscover New Reads Just in Time for Book Lovers Day

Picture a cozy nook as you immerse yourself in the pages of a captivating story. Welcome to the enchanting realm of Book Lovers Day, a celebration of literature and the transformative power of reading, recognized on August 9.

Learn MoreASU Prep’s Internship Program: Setting up Students for College and Career Success

In honor of National Intern Day on July 27th, we want to shine a spotlight on ASU Prep's internship program, designed to support high school students on their journey toward higher education and fulfilling careers.

Learn MoreSummer Tips: Get Kids Out of the House

Learning should be - and can be - fun. Summer is the perfect time to engage your learners in meaningful opportunities to be curious, to explore, and to discover new interests.

Learn MoreMinority Mental Health Month: Tips for Prioritizing Wellness

Observed in July, National Minority Mental Health Month brings awareness to the unique challenges faced by our nation’s minority groups. Due in part to a history of cultural stigma and lack of access to health care services, these groups often struggle to receive diagnoses for behavioral health issues.

Learn MoreNurturing Children’s Mental Health

ASU Prep recognized May 11th as National Children’s Mental Health Awareness Day, which highlights the importance of children’s positive mental health as part of their overall development.

Learn MoreCelebrating Teacher Appreciation Week at ASU Prep

Thank you to all our hard-working ASU Prep Academy staff and teachers who most definitely deserve extra credit.

Learn MoreAnti-Bullying Tips for a Positive Community

ASU Prep does not tolerate bullying, harassing or intimidating others on school grounds, school-sponsored events, or through use of technology.

Learn MoreHelp Us Celebrate Our 2023 Teacher of the Year Nominees

At ASU Preparatory Academy, we recognize excellence in teaching, and want to thank all teachers for their skill, knowledge, and dedication to the profession. We are thrilled to announce the nominees selected for ASU Preparatory Academy’s 2023 Teacher of the Year. Meet our exemplary educators:

Learn MoreCheers to Our 2023 Staff Member of the Year Nominees

On behalf of ASU Preparatory Academy, we want to recognize our outstanding education support personnel for their significant contributions to our school and students. Meet our incredible 2023 Staff Member of the Year nominees:

Learn MoreGameOn! At ASU Prep South Phoenix

It was GameOn! April 1 when ASU Preparatory Academy South Phoenix held an all-out game themed event at the high school campus.

Learn MoreSpring Comes to Life at Spring Fling Multicultural Festival

On March 24, spring came to life at the ASU Preparatory Academy Phoenix campus. The tuition-free public charter school hosted a Spring Fling Multicultural Festival for the community.

Learn MorePassover: Celebrating Freedom and Family

Students of all religions, cultures, and beliefs call ASU Prep home, and we are honored to include and welcome them.

Learn MoreChristians Celebrate Easter with Hope and Joy

Christians around the world celebrated Easter this past Sunday, which commemorates the resurrection of Jesus on the third day after his crucifixion.

Learn MoreASU Preparatory Academy’s Innovative People, Programs Earn High Honors at 2023 Edtech Awards

A forward-thinking, innovative approach to education is once again earning accolades for ASU Preparatory Academy and its leadership team.

Learn MoreASU Prep Pilgrim Rest Creates STEAM-Stravaganza

Last month, ASU Prep Pilgrim Rest hosted a STEAM-Stravaganza to celebrate Science, Technology, Engineering, Art, and Math with the community.

Learn MoreASU Honors Black History Month with Community Events

Black History Month is an annual celebration of achievements by African Americans and a time for recognizing the central role of Black people in U.S. history.

Learn MoreForbes names ASU one of Best Large Employers in US

On Feb. 15, Forbes listed Arizona State University as one of America’s Best Large Employers for 2023.

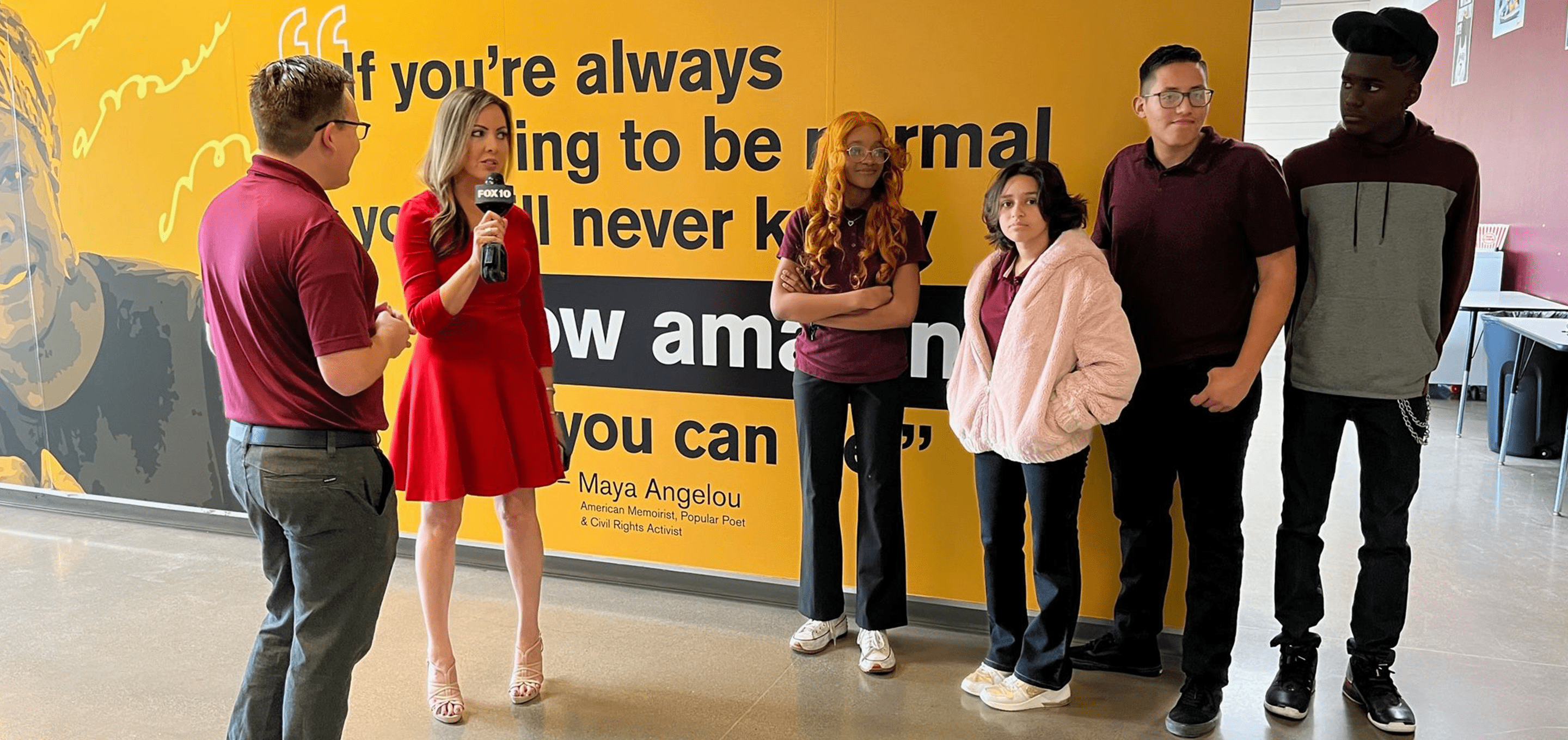

Learn MoreBlack History Month Murals Serve to Inspire Students

PHOENIX — Walk down the halls at ASU Preparatory Academy Phoenix Downtown Campus, and you will see multiple, life-sized faces including Barack Obama, Maya Angelou and Kobe Bryant.

Learn MoreASU Prep Academy South Phoenix Celebrates Día De Los Muertos with Community

ASU Prep South Phoenix invited families to celebrate the Day of the Dead holiday with them at the school’s 7-12 campus.

Learn MoreASU Prep Academy Phoenix Creates Let it Snow Community Event

The school hosted a free winter-themed celebration, “Let it Snow.” The community was invited to participate in seasonal holiday fun with the promise it would snow in downtown Phoenix—and snow it did!

Learn MoreTax Credit: Support Sun Devils

All end-of-year tax credit contributions support academic success, clubs, arts and culture, athletics, and more.

Learn MoreFamily Night Skate Party

Join us for Family Night Skate Party at Great Skate on Wednesday, Jan. 11, from 5-8:30 p.m.

Learn MoreWanted: Your Old Uniforms

Consider donating your old uniform polos, pants, and skirts to our loaner uniform closet.

Learn MoreArizona Tax Credit Contributions

Donate today to make a difference in the lives of our students.

Learn MoreSupport Our School with Amazon Smile

By using this link every time you shop, a portion of the proceeds will be donated to our school!

Learn MoreDreamscape Learn Work Experience – Level up with next-generation learning

Students, want to gain experience working with people and technology? You can, through Dreamscape Learn (DSL) Work Experience.

Learn MoreASU Preparatory Academy South Phoenix Art Inspires Students

ASU Preparatory Academy South Phoenix students returned from fall break to find some unexpected inspiration on campus.

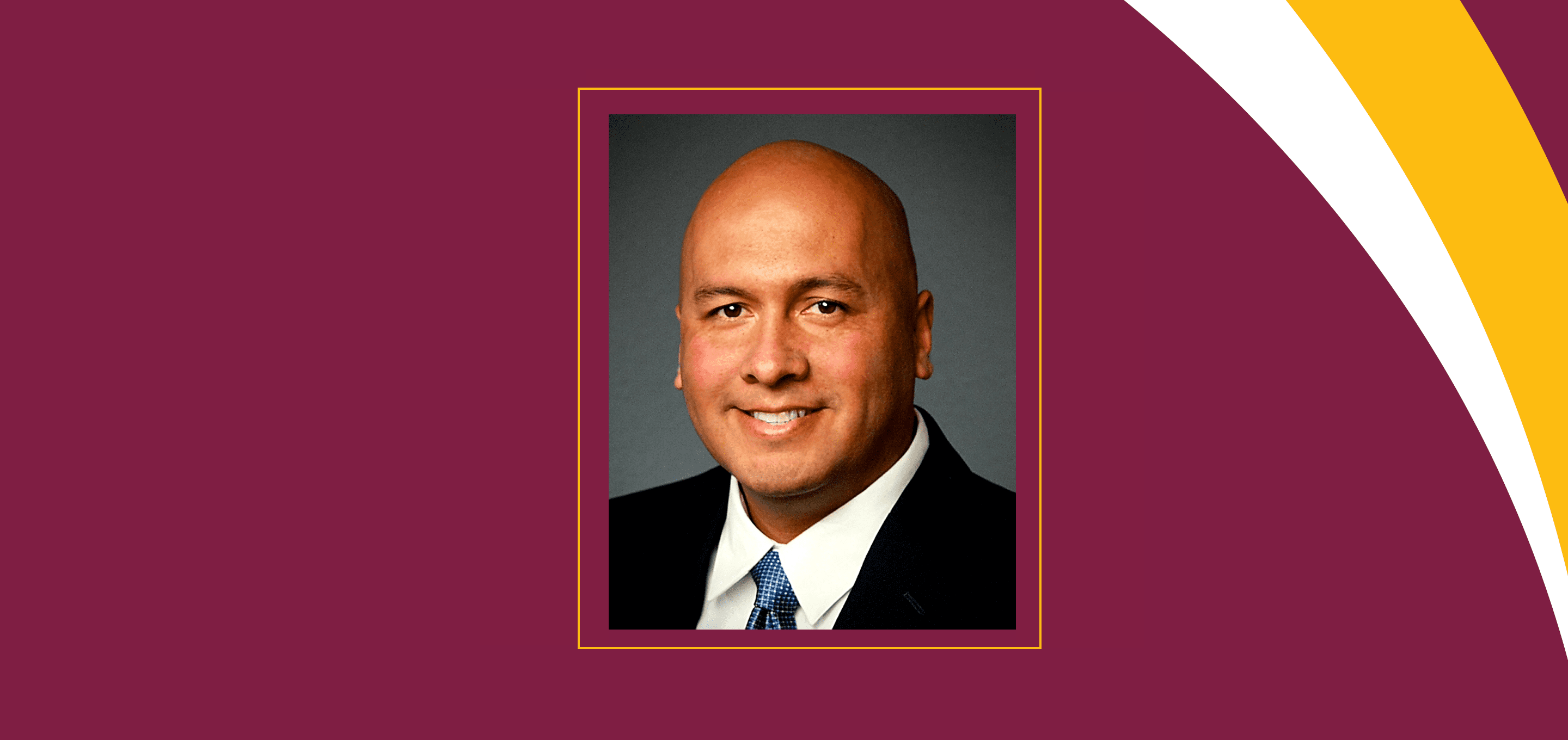

Learn MoreWelcome Michael Hernandez

ASU Preparatory Academy is pleased to welcome Michael Hernandez to the team.

Learn More